Why Invest in Real Estate?

By Adam McCarthy

Owner/Broker

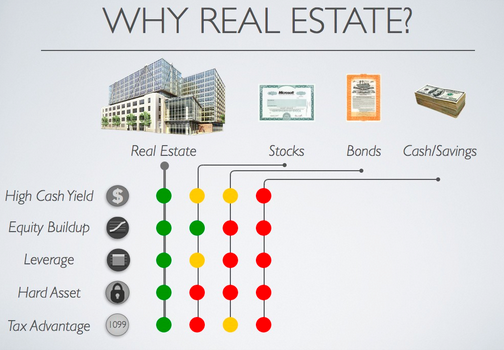

One of the most common questions I get asked is why invest in real estate versus other opportunities (stock market, crypto currencies, bonds, life insurance, etc.) I do believe in a balanced financial portfolio, including the items just listed, but my favorite is real estate. The investment in real estate is a steady, get rich slow game; but it’s more predictable in my opinion while still achieving the rate of return that is needed to become financially stronger.

Real Estate is not as sexy as bitcoin, but what exactly is bitcoin? Disclaimer – I own bitcoin, but I am not 100% sure why. I am up 400% this year in my bitcoin investment, hard to argue against that level of growth, but I put less than 1% in that investment compared to 90% in real estate. I could not take the risk of putting much more in a crazy speculative play, especially when I know the results on my rental investments are great with 10-15% returns consistently.

Real Estate also has great tax advantages. Depreciation is a huge help when it comes to not paying taxes on your income in this industry. Digging deeper into this you can really offset some other income (in certain situations) to help your tax situation. Everyone complains about “the rich” not paying taxes and making a ton of money. The larger question is, why do not all take advantage of the legal real estate tax laws in place now for everyone?

How do you make money in real estate? 3 ways:

- Cash flow – the tenant pays rent and you have expenses. The net is your cash flow. Principle paydown – leveraging bank money gives you a mortgage. Every month one of your expenses is a mortgage payment and this payment is principle and interest. The principle is your money in equity. Appreciation – the property grows in value 1-3%.

- The long game – Take this example, you buy a building and do a 25-year amortization. In those 25 years you do make money, but not the big money you expect. The bank payment is a large portion of profit, but once the bank is paid off is where you see the return you deserve for being patient.

- 1031 – another useful tool in real estate investing is the ability to make money on a property over time, sell it, and buy a bigger property, without paying taxes. You can defer the gain into the next property creating cash/profit to exponentially increase your portfolio.